News

RACGP payroll tax media blitz continues

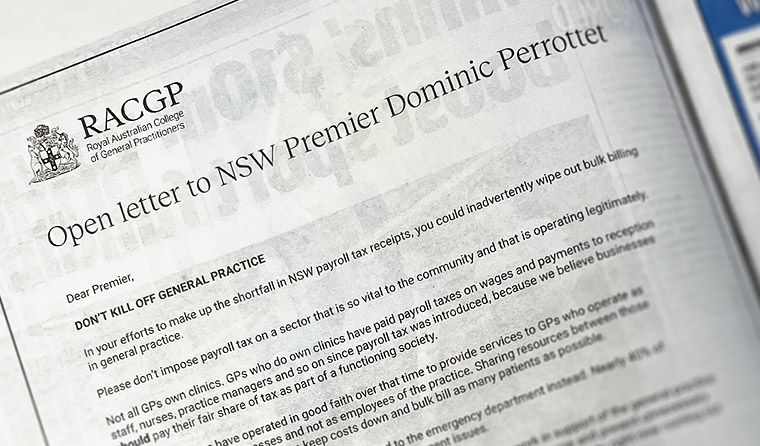

The college has taken out full-page ads in major Sydney newspapers ahead of the NSW election, urging the Premier to not ‘kill off’ general practice.

The full-page ads appeared in the Sydney Morning Herald and the Daily Telegraph.

The full-page ads appeared in the Sydney Morning Herald and the Daily Telegraph.

The RACGP has published an open letter addressed to NSW Premier Dominic Perrottet, warning him that a proposed new payroll tax interpretation could end bulk billing and result in the closure of up to 20% of general practices in the state.

Signed by President Dr Nicole Higgins and NSW&ACT Chair Associate Professor Charlotte Hespe, the letter appeared in prominent positions of both the Sydney Morning Herald and Daily Telegraph.

Dr Higgins told newsGP the ads have been designed to send a very public message to Premier Perrottet about the likely consequences of applying payroll tax on tenant doctors.

‘Queensland has generated the majority of headlines this year, but New South Wales has actually been one of the states leading the charge on this misguided tax grab,’ she said.

‘Make no mistake, this is a tax on patient care that will fundamentally change the way general practices operate and especially impact the most vulnerable members of society.’

The RACGP President also said that general practice already pays payroll tax and ‘should not have to pay it twice’.

‘This is a state tax on Medicare and will undermine any Federal Medicare reform,’ she said.

‘The college is doing everything it can to raise public awareness about this issue, and will continue to fight for our members and patients.’

The letter to Premier Perrottet begins with a simple message – ‘DON’T KILL OFF GENERAL PRACTICE’ – and warns that changing the decades-old interpretation of payroll tax law could ‘inadvertently wipe out bulk billing in general practice’.

It goes on to implore the Premier to consider the implications of such a move, and also points out that it would be in direct contradiction to public comments he has made regarding the need to support general practice.

‘Unnecessary taxes in healthcare lead to bad outcomes for the community. But you know that – after all, NSW already exempts public hospitals and public ambulance services from payroll tax,’ the letter states.

‘You’re on record as saying that the NSW public health system needs to work in support of the general practice network, that NSW needs more bulk billing doctors to treat patients free of charge and prevent unnecessary emergency department visits clogging up hospitals.

‘So please, Premier, don’t impose payroll tax on general practice earnings … [and] urge your fellow Premiers in the National Cabinet to make the same commitment to GPs and to voters.’

The letter also highlights that general practice owners already pay payroll tax on wages and payments to reception staff, nurses, practice managers, and that extending it to tenant doctors would have a net negative outcome through an increase in more expensive emergency department care.

‘We believe businesses should pay their fair share of tax as part of a functioning society,’ the letter reads.

‘General practices have operated in good faith … to provide services to GPs who operate as independent small businesses and not as employees of the practice. Sharing resources between those small businesses helps practices keep costs down and bulk bill as many patients as possible.

‘We know that if patients can’t see a GP, they head to the emergency department instead. Nearly 40% of presentations to emergency departments are for non-urgent issues.

‘Let GPs get on with keeping people healthy.’

The letter concludes by listing the predicted fallout from applying payroll tax to tenant doctors, considering that the vast majority of GPs have indicated they would have to pass the cost on to patients or close altogether.

Likely consequences include:

- a dramatic fall in the number of patients who are bulk billed by a GP

- a material increase in out-of-pocket expenses for people who see a GP

- a significant increase in ambulance ramping and wait times at emergency departments

- more rural and remote communities losing their doctors

- an irrevocable change the way general practice services are delivered to patients and their communities

- a resulting blow-out in NSW health sector costs that voters will be forced to wear.

In addition to the full-page ads, an RACGP spokesperson told

newsGP that college representatives made more than 190 media appearances regarding payroll tax in the first month of 2023, which with syndication have been picked up more than 550 times by newspapers, online media, radio shows and television news programs across the country.

Read the ad’s full text below:

Open letter to NSW Premier Dominic Perrottet

Dear Premier,

DON’T KILL OFF GENERAL PRACTICE

In your efforts to make up the shortfall in NSW payroll tax receipts, you could inadvertently wipe out bulk billing in general practice.

Please don’t impose payroll tax on a sector that is so vital to the community and that is operating legitimately.

Not all GPs own clinics. GPs who do own clinics have paid payroll taxes on wages and payments to reception staff, nurses, practice managers and so on since payroll tax was introduced, because we believe businesses should pay their fair share of tax as part of a functioning society.

General practices have operated in good faith over that time to provide services to GPs who operate as independent small businesses and not as employees of the practice. Sharing resources between those small businesses helps practices keep costs down and bulk bill as many patients as possible.

We know that if patients can’t see a GP, they head to the emergency department instead. Nearly 40% of presentations to emergency departments are for non-urgent issues.

You’re on record as saying that the NSW public health system needs to work in support of the general practice network, that NSW needs more bulk-billing doctors to treat patients free of charge and prevent unnecessary emergency department visits clogging up hospitals. And that there is a real opportunity right now coming out of a 100-to-150-year pandemic to reform the NSW health system.

The RACGP agrees.

GPs and general practices have told the RACGP that if payroll tax is imposed on practice earnings:

- almost 20% of general practices will be forced to close

- nearly 80% of GPs would have to pass the payroll tax on to patients as gap payments and increased fees

- many of our GPs would leave general practice altogether.

Unnecessary taxes in healthcare lead to bad outcomes for the community. But you know that – after all, NSW already exempts public hospitals and public ambulance services from payroll tax.

So please, Premier, don’t impose payroll tax on general practice earnings, unless you want to see:

- a dramatic fall in the number of patients who are bulk billed by a GP

- a material increase in out-of-pocket expenses for people who see a GP

- a significant increase in ambulance ramping and wait times at emergency departments

- more rural and remote communities losing their doctors

- an irrevocable change to the way general practice services are delivered to patients and

- their communities

- a resulting blow-out in NSW health sector costs that voters will be forced to wear.

Urge your fellow Premiers in the National Cabinet to make the same commitment to GPs and to voters.

Let GPs get on with keeping people healthy.

Log in below to join the conversation.

advocacy Medicare payroll tax

newsGP weekly poll

Are you interested in prescribing ADHD medication?